Omega Capital Management LLC is brought to you by The New Albany CPA Co.

Now accepting clients in all 50 states.

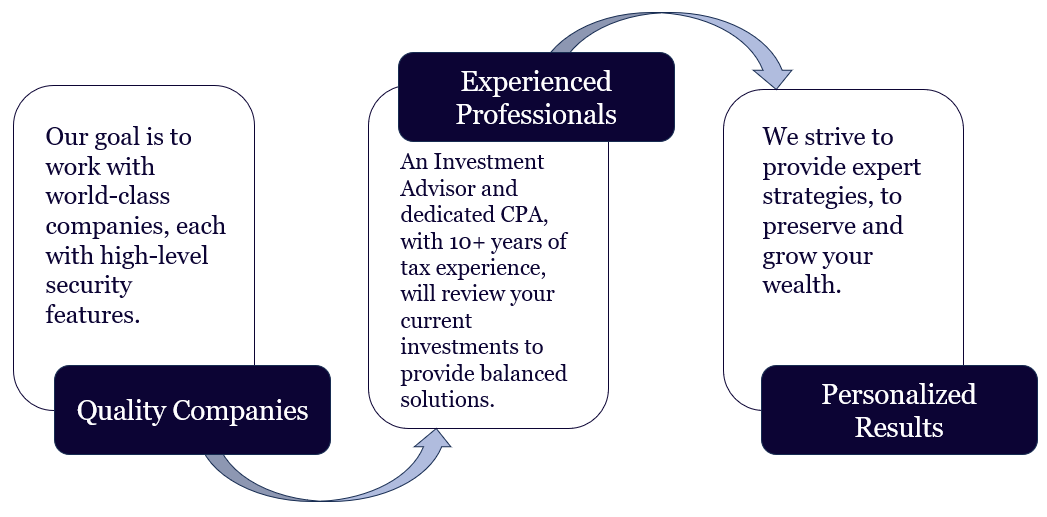

A secure, personalized, and expertly-crafted experience is waiting for you.

Real solutions, for when you need them

We’ll help you answer your most important investing questions, like:

-

Capital preservation is our special emphasis. Using empirical data and extensive research, we believe we have the very best strategy for investors, who not only want to keep their money in the long-term, but also maintain a healthy growth rate.

-

There are many investment choices, among which are stocks, bonds, ETF’s, and mutual funds, with various quality levels and fees for each type. Some fees are “hidden”, in that they won’t be listed on your statement, but can still be found.

When you have an appointment with us, we’ll show you a simple, yet powerful, way to look at a portfolio that compares essential information like risks, quality levels, fees, and growth rates.

As a starting point, it’s a great way to see if your current investments align with your risk comfort level and goals.

-

Having an Employer Retirement Plan is one of the best deductions available, plus a great way to reward your employees.

Whether you have many employees or no employees, are a one-owner firm or a multiple owner firm, we can show you the pros and cons of each retirement plan so you can choose the best one for your business.

Some of the perks of personal investing with us:

-

Receive access to a private phone line for your questions as a client of Omega Capital Management LLC.

-

For Personal Investing, our proprietary blend of securities includes state tax-exempt offerings in every portfolio. We also position any income and gains to be taxed at lower rates (typically 15%), when possible.

In addition, for example, we’ll keep a close watch on if/when Required Minimum Distributions are required, IRA basis tracking, and can provide guidance on very specific areas, like Inherited IRA’s (which have several possible, and complex, treatments).

-

We want to protect our clients when their life circumstances change.

That means coordinating amongst all parties to have existing Power Of Attorney forms on file, as well as listing beneficiaries on the account, starting at application.

These are just a few of the items we check for to assist with a smooth transition.

We once had a sad situation where a young widow came to us in distress because her late husband’s IRA had not been properly rolled over within the required 60 day time period. The other brokerage had cut her a check, which typically makes an event instantly taxable. Because we knew about a rare exception, however, we were able to undo the 10% penalty, reverse the additional 24% tax due, and return the funds to her tax-protected IRA for a 34% total savings.

We can help set up a new 401(k) or manage an existing one.

We’re Your 401(k) Advocate

Employer Retirement Plans and their related IRS Safe Harbor rules can be complex. One of our clients wanted to set up a new 401(k) plan for 2024 and contribute the full $23,000 as a deduction.

No problem, except that the owner has employees. Following the typical rules would put this company out of compliance, short the employees part of their compensation, and put the owner’s deduction at risk. Fortunately, we know the exceptions, and the right way get this done so everybody wins. The owners get their $23,000 deduction, plus thousands of dollars in tax credits over the next few years, and the employees get extra money for their savings.